When you are planning on moving to the beautiful country of Spain, there will be certain things that you will need to have covered to…

Read More Moving to Spain: Your Emigration EssentialsYear: 2018

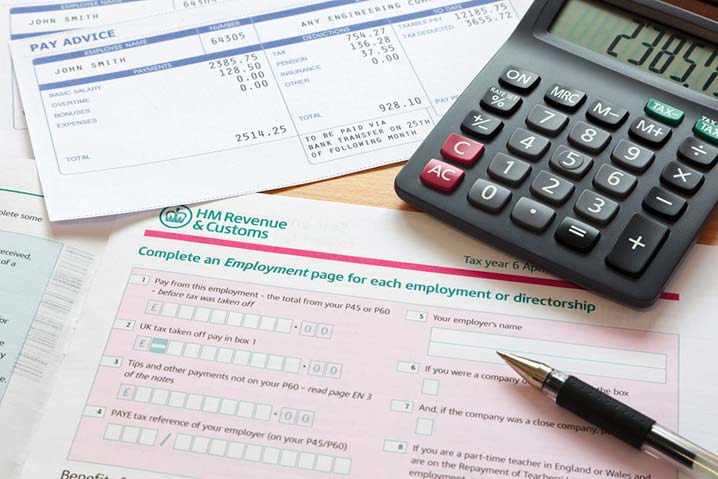

How to file your UK tax return with ease

Understanding HMRC’s Self-Assessment System If you have not filed your tax return yet do not feel bad as this article will help you understand the…

Read More How to file your UK tax return with ease