Article Chapters

Understanding HMRC’s Self-Assessment System

If you have not filed your tax return yet do not feel bad as this article will help you understand the commonalities of how to file your UK tax return correctly.

We aim to enlighten you and dispel myths and other misinformation which may be holding you back from accomplishing knowing how to file your UK tax return correctly.

We will do our best to cover all the different angles necessary.

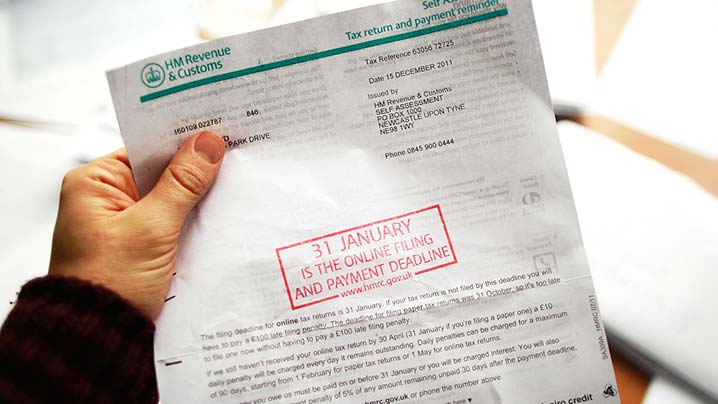

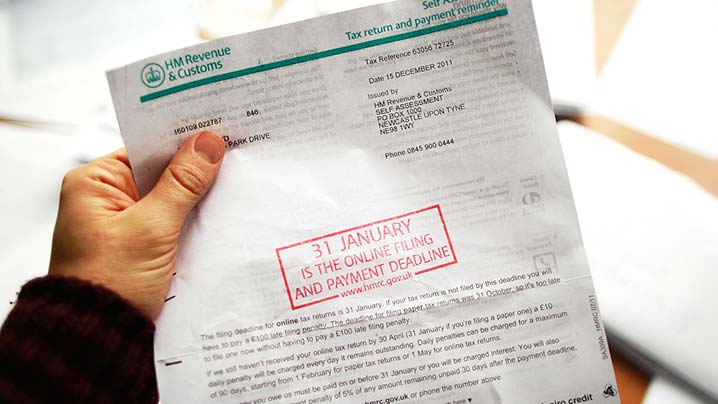

As you may or may not know you are required to file your taxes by January 31st of this year.

If you miss this deadline you can possibly face a £100 fine and you may face even more penalties if you are extremely late.

There are two options for filing your tax return with the online version and the paper format.

Both are essential and we will show you how to get it done properly as you continue reading below.

Who Needs to File a Tax Return?

You will need to fill out a tax return if you are self-employed have a job or do any type of freelance or casual work.

All income that you earn through the year has the potential of being taxable.

You will have to fill out a tax return if you have £2,500 or more in untaxed income from things like property, investments or savings.

Secondly, you will have to file a tax return if your investment or savings income was £10,000 before tax.

Also if your income was more then a £100,000 or if you made a profit from selling a rental property then you will be required to pay a capital gains tax.

This report is designed to offer tips and suggestions and for further requirements we recommend you visit the official HMRC website to get all the exact details.

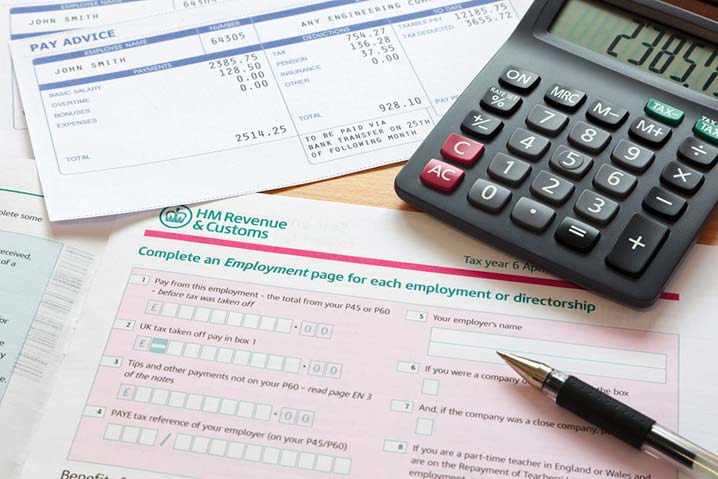

Get All Necessary Documents Together

The very next thing you will need to do is get a hold of your bank statements, household bills, invoices, a copy of your P60 as well as your P11D.

If you don’t have access to either of these forms then be sure to contact the payroll office of where you work for the required paperwork to get your taxes done.

If you have never filed your taxes you will need to register as a new user at the HMRC online services website.

You will need your 10 digits unique taxpayer reference number.

Next, you will be given a unique user identification that you will need to hold on too for future use.

You will receive an activation code when you signup.

Once you have received it you can log into the HMRC Self Assessment portion of their website.

If you have already signed up for self-assessment online then you don’t have to go through signing up and activating your account again.

You will just need to use your user identification as well as password.

If your tax affairs are marked as “relatively straightforward” then the HMRC will take you out of the self-assessment tool.

If this applies to you the HMRC will send you a letter stating you no longer have to fill out a form for taxes.

Some people would like to know how to file your UK tax return correctly in a way that will reduce the overall bill.

Always Claim Expenses

One method for lowering your bill is by claiming expenses.

If you are a home-based business owner you can claim a percentage of your heating, electricity, internet and telephone bills.

You can even claim a portion of your mortgage or rent, insurance and even charges from the bank.

You can also do such things as claiming expenses associated with your business such as new computers, vehicles used in business, the costs of petrol as well as car repairs.

However, you cannot claim these expenses if you are working at home for a full-time employer.

If you worked offshore on a cruise ship, yacht or seaborne vessel outside of UK waters for a considerable length of time, the you may be able to claim Seafarers Earnings Deduction.

The rules surrounding this exemption are complex so you are advised to consult seafarers tax accountants for help and guidance.

This isn’t all the information you need to know about on how to file your UK tax return correctly.

We highly recommend that you visit and review the helpful HMRC website or you can always call their self-assessment helpline.

The phone number is active from Monday to Saturday and the phone number is 0300 200 3310.

They are there to help you and answer any questions that you may have about filing your taxes.

Sometimes it may take a little while to reach a live operator on the helpline but it is worth it if you need help.

Ultimately filing your taxes on time is the best option available as you will not have to spend money on any penalties or fines.

Be sure to file on time!

Article Sources

The author wishes to acknowledge the following external sites for use of text, images and reference material: